massachusetts estate tax rates table

The credit on 400000 is 25600 400000 064. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

The state sales tax rate in.

. 352 rows Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes. Any gains when you sell inherited investments or property are generally taxable but you can usually also claim losses on these sales. 50 personal income tax rate for tax year 2021.

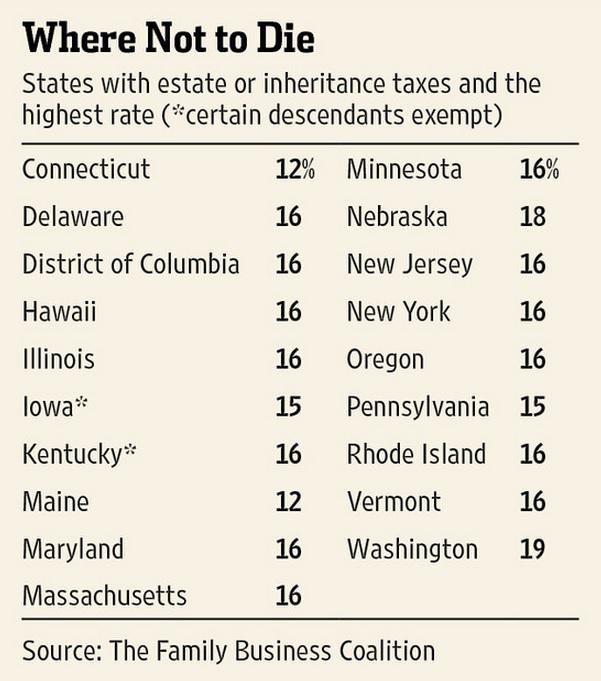

The top estate tax rate is 16 percent exemption threshold. 402800 55200 5500000-504000046000012 Tax of 458000. Ad From Fisher Investments 40 years managing money and helping thousands of families.

In Massachusetts all taxes. How Much Is Estate Tax In Massachusetts. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold.

This means if your estate is worth 15 million the tax applies to all 15 million not just the 500000 above the exemption. 22 rows Massachusetts Estate Tax Rates. The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax.

Massachusetts uses a graduated tax rate which ranges between. Additionally because the taxable estate of. Massachusetts Estate Tax Rates.

What are the estate tax rates in. Example - 5500000 Taxable Estate - Tax Calc. Up to 100 - annual filing.

Massachusetts State Single Filer Personal Income Tax Rates and Thresholds in 2022. The estate tax is a transfer tax on the value of the decedents TAXABLE estate before distribution to any beneficiary. If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. If the estate is worth less than 1000000 you dont need to file a return or.

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest. In this example 400000 is in excess of 1040000 1440000 less 1040000. 17 rows Tax year 2022 Withholding.

The exemption is not portable between spouses. If youre responsible for the estate of someone who died you may need to file an estate tax return. The maximum credit for state death.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. In other words if your estate is valued over the 1 million threshold there will be no tax on anything over 400000. For estates of decedents dying in 2006 or after the.

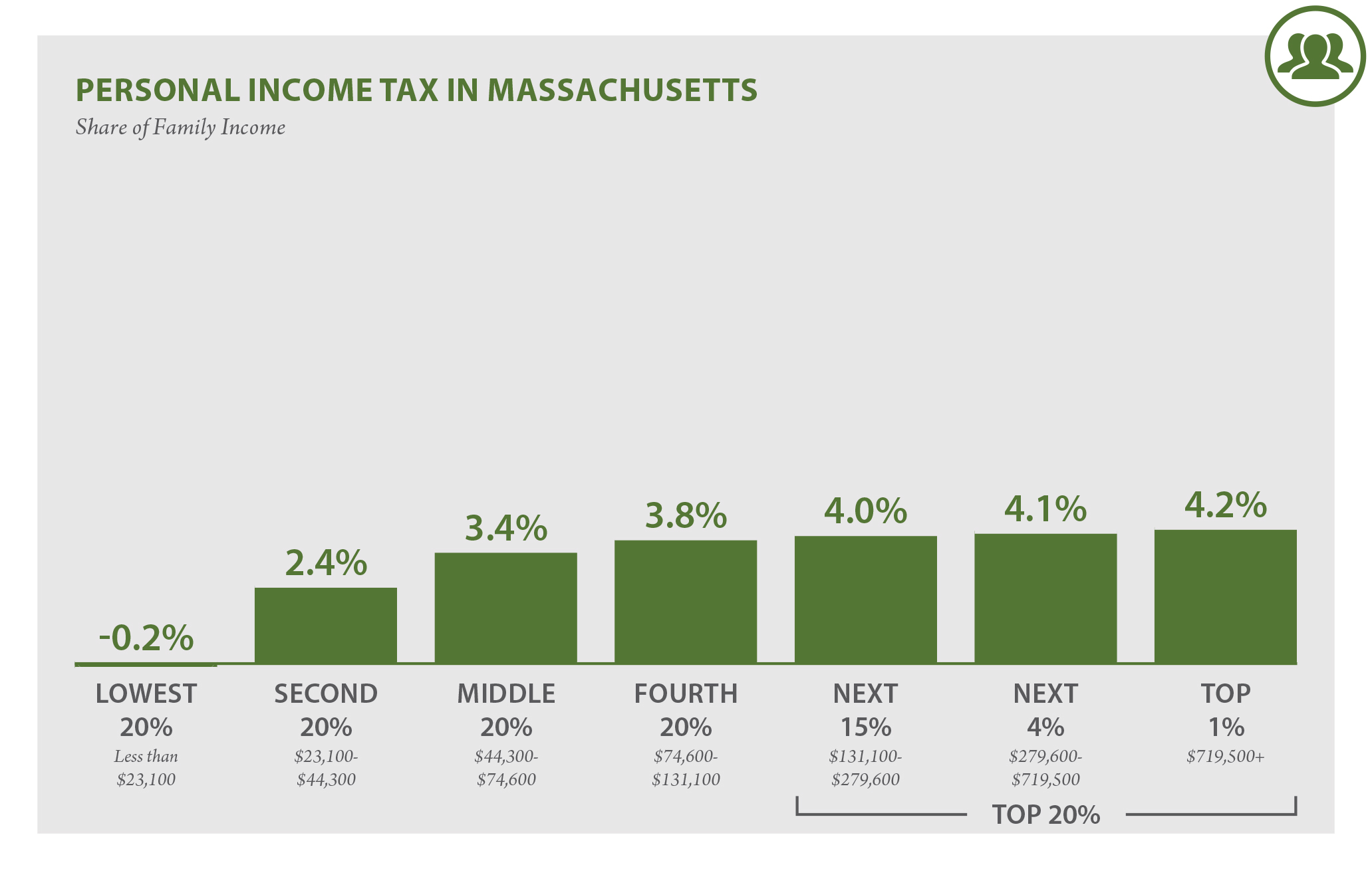

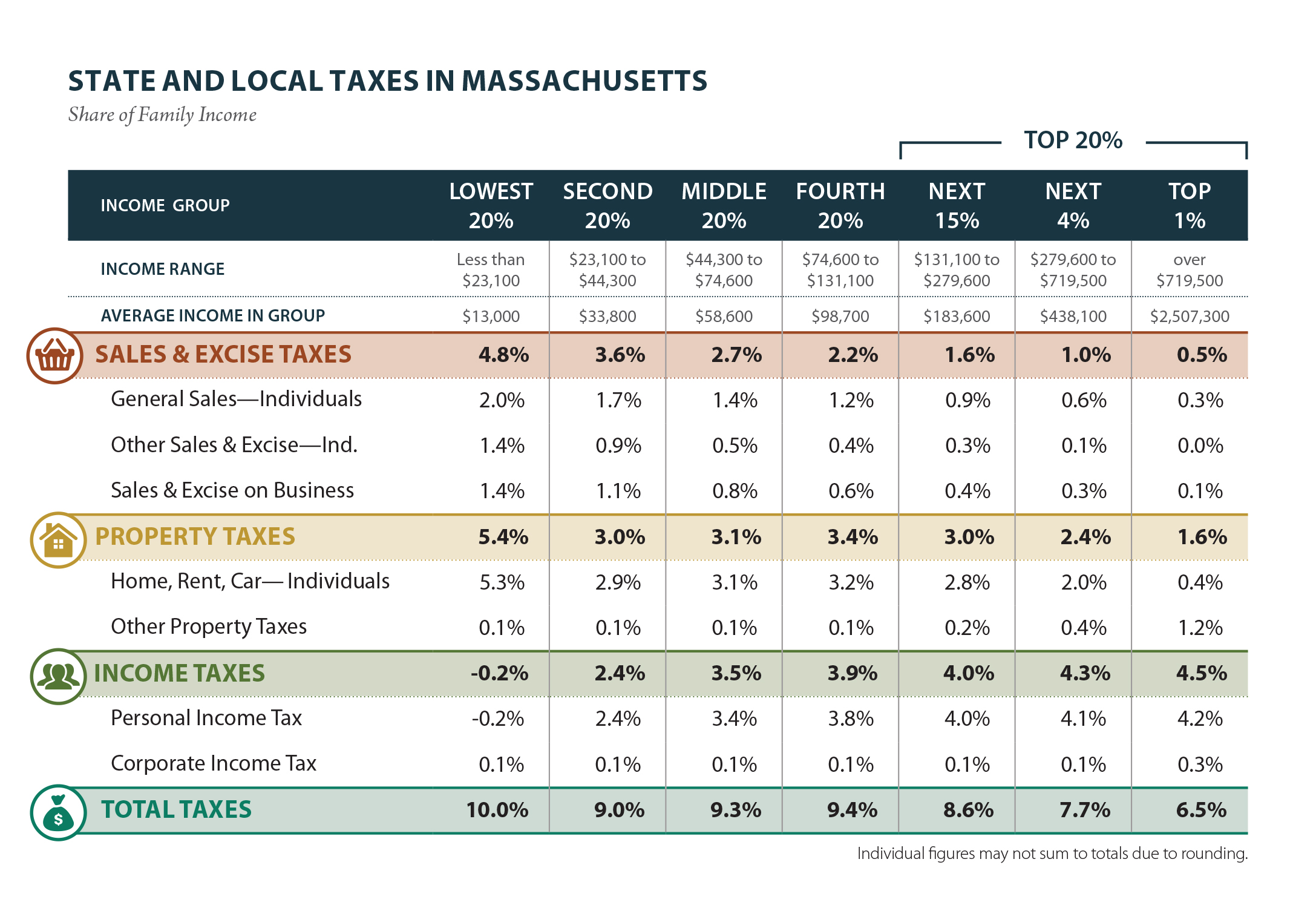

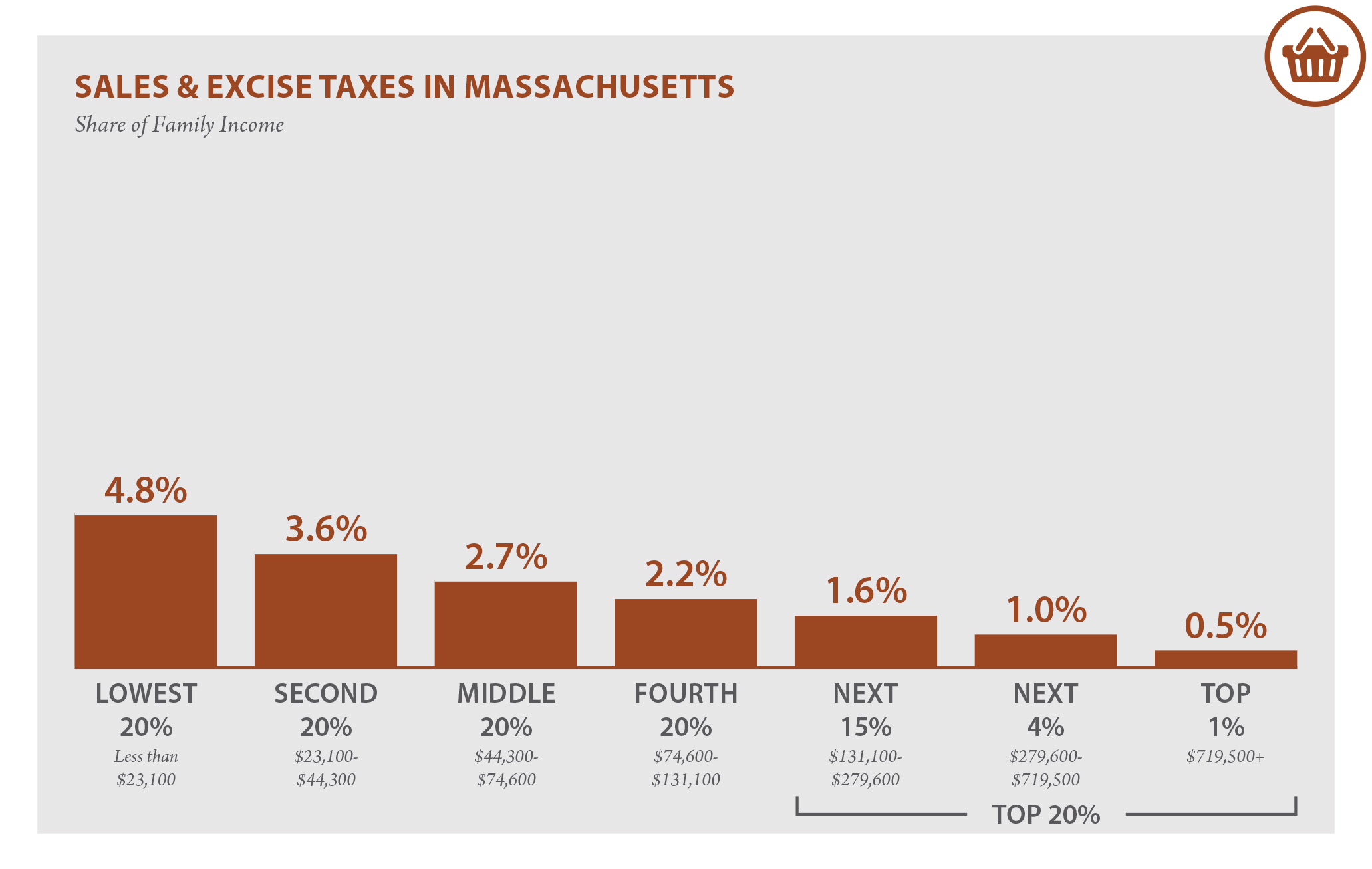

Massachusetts Who Pays 6th Edition Itep

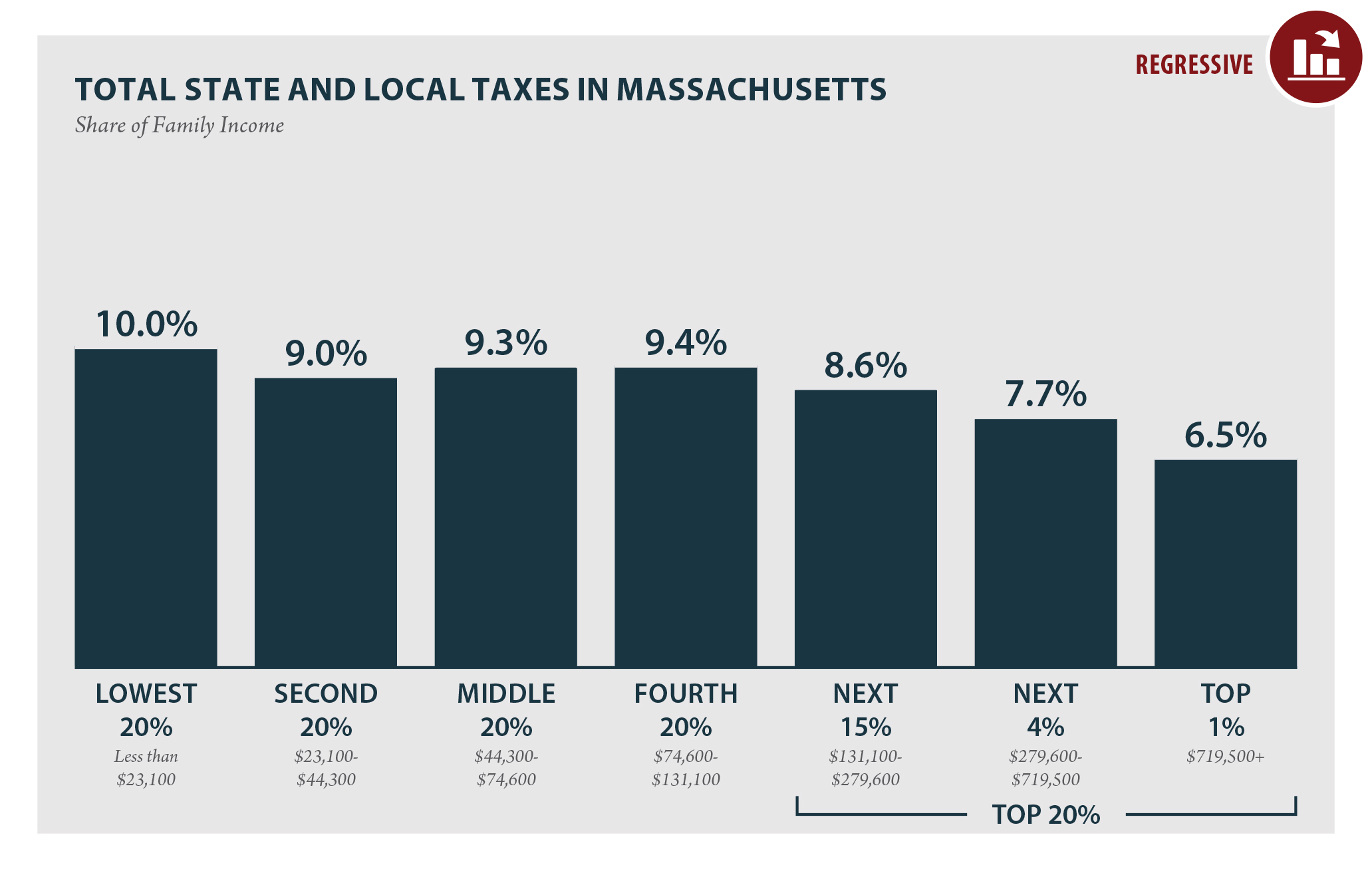

Massachusetts Who Pays 6th Edition Itep

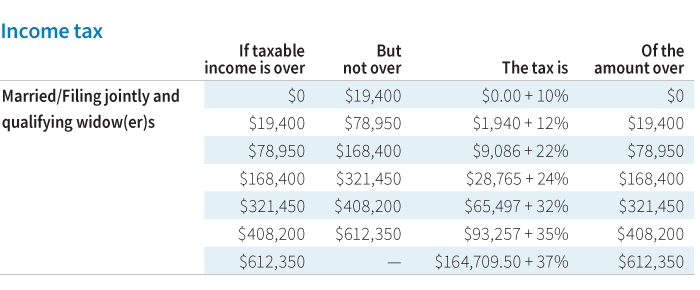

The Kiddie Tax Changes Again Putnam Investments

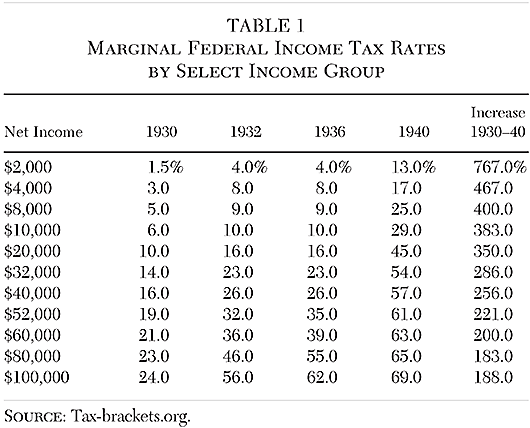

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

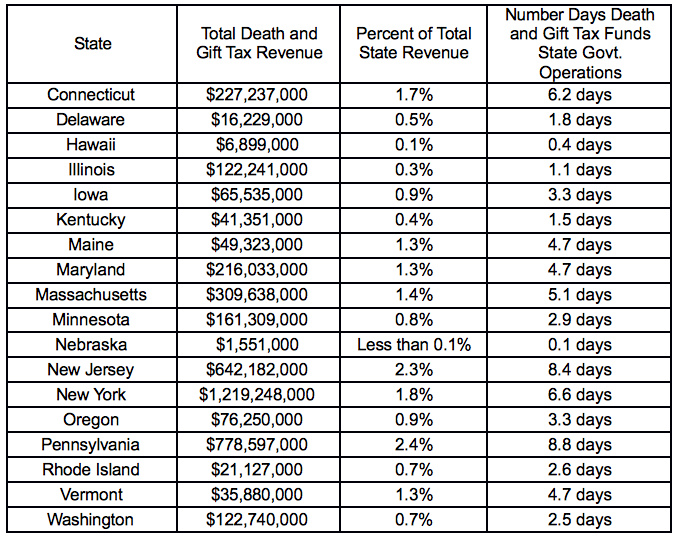

The Death Tax Taxes On Death American Legislative Exchange Council

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State And Local Individual Income Taxes Work Tax Policy Center

Massachusetts Estate And Gift Taxes Explained Wealth Management

The Death Tax Taxes On Death American Legislative Exchange Council

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do Millionaires And Billionaires Avoid Estate Taxes

Massachusetts Who Pays 6th Edition Itep

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset