after tax income calculator iowa

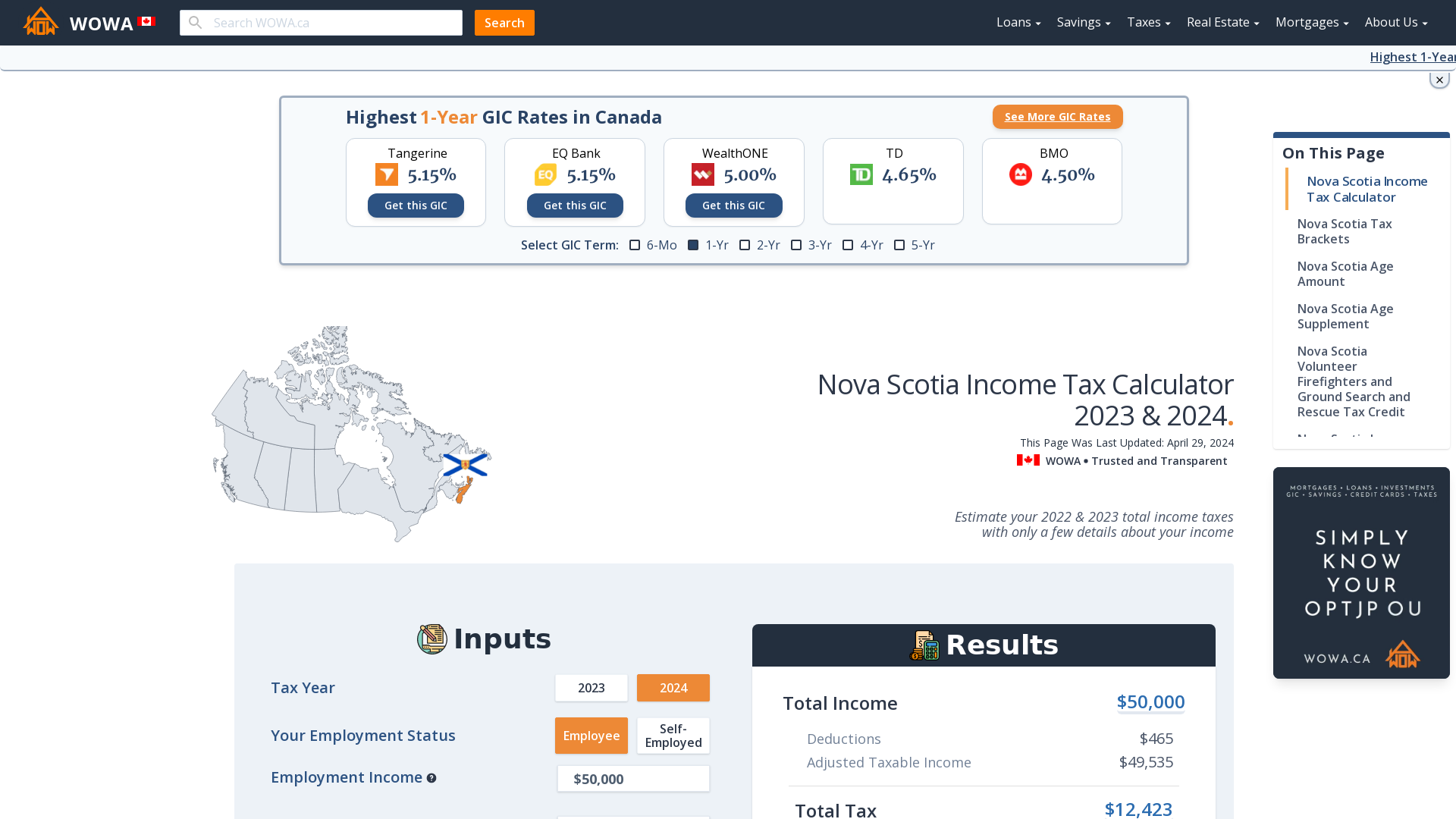

Iowa does not have any local city taxes so all of your employees will pay only the state income tax. The result is net income.

How Much Should I Set Aside For Taxes 1099

This Iowa bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

. Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the calculator this includes historical tax years which are. Filing Made Easy provides a quick look at the process of filing an Iowa income tax return including Common Mistakes to avoid. This free easy to use payroll calculator will calculate your take home pay.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Salary Before Tax your total earnings before any taxes have been deducted. Unlike the Federal Income Tax Iowas state income tax does not provide couples filing jointly with expanded income tax brackets.

All residents and citizens in the USA are subjected to income taxes. Iowas maximum marginal income tax rate is the 1st highest in the United States ranking directly below Iowas. Also known as Gross Income.

Youll then get a breakdown of your total tax liability and take-home pay. Iowa Paycheck Calculator - SmartAsset. Tax season officially begins the same day as Federal return processing January 24 2022 and tax Iowa tax returns are due May 2.

Your total unpaid tax and penalty is now 550. However an annual monthly weekly and daily breakdown of your tax amounts will be provided in the written breakdown. Filing an Income Tax Return.

For instance it is the form of income required on mortgage applications is used to determine tax brackets and is used when comparing salaries. There are two types how lottery taxation works. Iowa Salary Tax Calculator for the Tax Year 202122.

Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. The rate ranges from 033 on the low end to 853 on the high end. We strive to make the calculator perfectly accurate.

So S - F Adjusted Taxable income for Iowa where F Full Federal Tax calculation and S State taxable income for Iowa. SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. If you filed your return on time but did not pay at least 90 of the correct tax due by the due date you owe an additional 5 of the unpaid tax.

Supports hourly salary income and multiple pay frequencies. Residents and citizens are taxed on worldwide income working overseas etc while nonresidents are taxed only on income within the jurisdiction. The Iowa bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. The Department processed over 173 million individual income tax returns in calendar year 2021. For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035.

Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Your average tax rate is 169 and your marginal tax rate is 297.

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions. Taxes on lottery winnings on lottery lump sum calculator. You must calculate interest on the 500 and add it to the 550.

The taxes that are taken into account in the calculation consist of your Federal Tax Iowa State Tax Social Security and Medicare costs that you will be paying when earning 12000000. You can learn more about how the. Related Income Tax Calculator Budget Calculator.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. In this tax example. Our Iowa State Tax Calculator will display a detailed graphical breakdown.

Free Online Paycheck Calculator Calculate Take Home Pay 2022. The provided information does not constitute financial tax or legal advice. Your total tax liability for the year is 2000.

If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. But the Department does more than your income tax return there were over 321000 withholding tax returns and 398000 sales and.

Enter your info to see your take home pay. This marginal tax rate means that your immediate additional income will be taxed at this rate. A tax year is different for the federal and state.

Enter your filing status income deductions and credits and we will estimate your total taxes. Switch to Iowa hourly calculator. How to calculate annual income.

State tax may vary from state to state in the USA. Interest is not charged on penalty. United States federal income tax.

5310000 - 486800 4823200. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. In the US the concept of personal income or salary usually references the before-tax amount called gross pay.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds in 2022. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The bonus tax calculator is state-by-state compliant for those states that allow. How to calculate taxes taken out of a paycheck. 328 rows After determining their Iowa state tax liability many Iowa taxpayers.

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income. Iowa Paycheck Calculator Smartasset. Federal tax may vary depending on the lottery winnings and federal tax bracketsthe different tax brackets for different income brackets.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. Our calculator has been specially developed in order to provide the users of the calculator with.

Up to 32 cash back Iowa charges a progressive income tax broken down into nine tax brackets.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Our Free Cost Of Living Calculator Allows You To Compare The Cost Of Living In Your Current City To Anothe Retirement Calculator Best Savings Account Financial

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

Income Tax Calculator 2021 2022 Estimate Return Refund

How To Calculate Self Employment Tax In The U S Child Support Calculator Ideas Of Child Support Calcu Child Support Child Support Quotes Birth Photography

Iowa Paycheck Calculator Smartasset

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Avoiding Double Taxation In Germany A Guide For Uk Expats Expat Focus Filing Taxes Tax Time Tax Season

Tax Withholding For Pensions And Social Security Sensible Money

Income Tax Calculator Estimate Your Refund In Seconds For Free

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Daycare Costs Child Support

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

State Sales Tax Help Tax Help Sales Tax Tax

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How Can We Improve This Page Tax Forms Property Tax Income Tax

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions